The Paris Agreement’s goal to limit global warming to well below 2 °C compared to pre-industrial levels will be challenged by decarbonization of several hard-to-abate sectors. The chemical industry along with cement, iron and steel, shipping, and aviation are among the hard-to-abate sectors. Hard-to-abate sectors are highly energy-intensive sectors where fossil fuels serve as the primary source as well as feedstocks and are seemingly difficult to substitute.

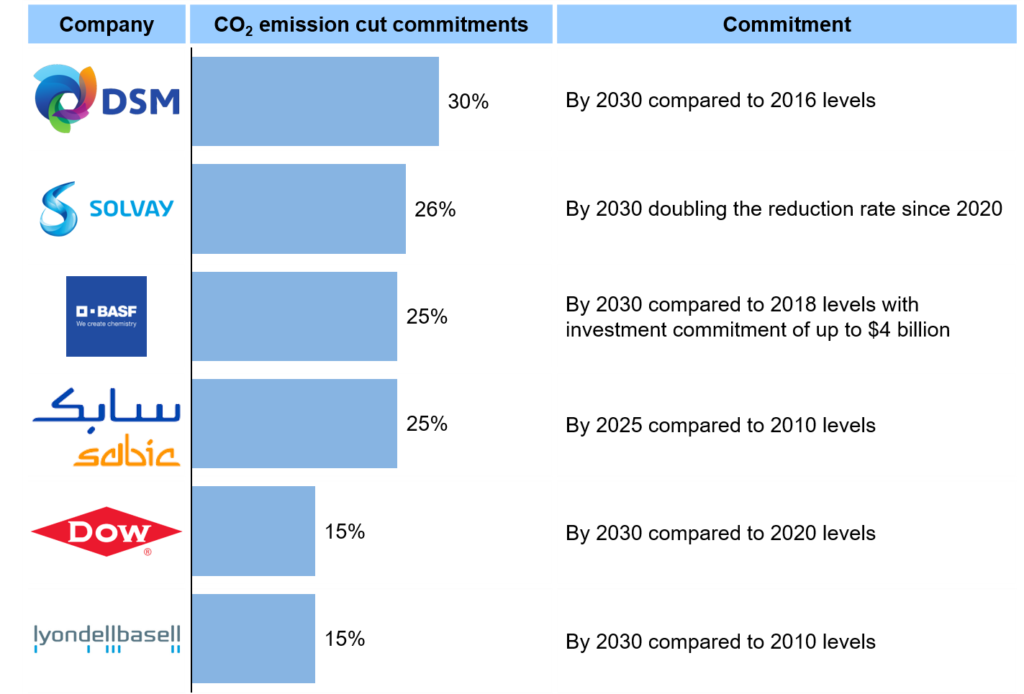

Pressures from government agencies, investors, and consumers are, however, driving decarbonization commitments in the chemical industry. Many companies in the chemical industry are committing to ambitious goals to reduce their CO2 emissions and ultimately achieve “net zero” status by 2050. Some have also committed to investment ranging from a few hundred million dollars in the near term to as much as $5 billion by 2030. The exhibit below summarizes decarbonization commitments by 2030 from a select set of players in the chemical industry.

Exhibit 1. Decarbonization goals and commitments announced by chemical companies

As can be observed from the exhibit, DSM has committed to cut emissions by 30% from 2016 levels and Dow and LyondellBasell have committed to cut emissions by 15% from 2020 and 2010 levels, respectively. Solvay aims to cut emissions by 2030 to 26% of 2020 levels, while Sabic aims to cut 25% of 2010 emissions level by 2030. BASF has made a commitment to cut 25% emissions from 2010 levels and estimates the investment required to reach their goal at almost $4 billion.

Normalizing the goals announced by the companies’ baselines, we observe that Solvay followed by DSM and BASF have set highly ambitious goals and it will be interesting to follow their journey. Companies have already accelerated efforts such as replacing fossil fuel with electricity in operations. For example, BASF, Linde, and Sabic are demonstrating electrification of a steam cracker at BASF’s site in Germany. A lot of the pressure for reducing CO2 emissions comes from Europe and we expect facilities of the above companies there to adopt cleaner technologies faster than the rest of the world.

ADI Analytics tracks global energy transition progress and trends, helps clients map various scenarios of limiting global warming, and its implications for the oil and gas, power, steel, cement, transportation, and petrochemical industries. This blog is part of a series based on research by ADI Chemical Market Resources targeted towards energy transition in chemicals and petrochemicals. Contact us to learn more.

By Panuswee Dwivedi and Uday Turaga