My Turn – Dr. Balaji B. Singh – New found focus on Africa –Middle East – The Last Frontier!

Comments: Without exception, the major trend for the future will involve Africa – Middle East, Eastern Europe, and/or a combination thereof with China and India. It is a tribute – great minds think alike! Almost all the major petrochemical companies are about to/or already have announced their strategic plans covering these new regions.

This newfound focus on heretofore neglected/ignored regions is expected to give growth in the commodity plastics missing in the established or Nuevo-rich regions of the world. So take a last look at the ASEAN countries that were in the limelight over the last decade.

The only thing constant in this world is change! The whole world is moving with fanfare towards the new growth regions – JOIN THE BANDWAGON OR WAIT TO CLEAN UP THE CONFETTI – THE CHOICE IS YOURS!

Dow to cease production at Union Carbide polypropylene manufacturing facility in Louisiana

Dow Chemical today announced that Union Carbide Corporation (UCC), a wholly-owned subsidiary of TDCC, will suspend production at its polypropylene manufacturing facility at St. Charles Operations in Hahnville, Louisiana, in anticipation of an expected decision to shut down the facility by year-end.

The planned shutdown of the facility will impact approximately 60 employees. It is expected that a large majority of those employees will be redeployed to other roles at St. Charles Operations.

Dow has begun its communication with suppliers and customers to facilitate the shutting down of the plant within the specified timetable. Dow will fulfill contractual obligations appropriately, but may not be able to maintain the current level of supply to all customers. The St. Charles site was part of the transaction in which Dow acquired UCC in 2001. The polypropylene plant has a capacity of 500 MM lbs.

Comments: The rationalization in the polypropylene capacity may have been partially triggered due to the new Spherizone plant in Mexico and the announcement of the restart of the Basell plant in the US. Recently Basell also announced the closure of two of its underperforming assets in Canada. This announcement will decrease Dow’s PP capacity in the US by a little over 35%. Dow still has a 250 KT PP plant in Freeport, TX, and a 150 KT PP plant in Seadrift, TX. Propylene for this plant was being sourced from an outside supplier. There is also some speculation that the announced closure may be linked to the recent joint venture announcements by Dow. North America will have a net loss of 30 KT of PP capacity after considering the plant closures by Basell and Dow and the additions by Basell in the US and Mexico.

Basell licenses Hostalen technology to PetroChina

PetroChina Company Ltd. has selected Basell’s Hostalen technology for two new high-density polyethylene plants; a 300 KT per year plant in Chengdu, Sichuan province, and a 350 KT per year plant in Fushun, Liaoning province, China. The start-up for both plants is expected to be in 2011.

Basell’s Technology Services group has also been working closely with PetroChina to optimize products for special market requirements on their existing Hostalen process plant in Jilin province, China.

According to Basell, PetroChina’s double license further reinforces the Hostalen process’ leading position in slurry technology for the manufacture of bi-modal HDPE products, with 6 million tons of licensed capacity worldwide. The main drivers for this growth have been the process’ ability to produce a broad product range for demanding applications, with renowned operational stability.

Comments: Basell has been extremely successful in polyolefins licensing activities over the last few years. In the last 4 years, the company has licensed Hostalen technology to (1) Salavatnefteorgsintez (Russia, Completion: 2006), (2) PetroChina (China, Completion: 2005), (3) Arak Petrochemical (Iran), (4) Gharb Petrochemical (Iran, Completion: 2007), (5) PetroRabhigh (Saudi Arabia, completion: 2008), (6) Indian Oil (India, Completion: 2007), (7) Tasnee (Saudi Arabia, Completion: 2008), (8) SABIC (Europe and Saudi Arabia, Completion: 2008), and (9) Project Management and Development Company (Saudi Arabia, Completion: 2009).

Basell has at its disposal a variety of process technology platforms to meet the ever-increasing demands of the polyethylene industry including Spherilene® (gas-phase), Hostalen® (bimodal slurry), Lupotech G® (fluid-bed), and Lupotech T® (high pressure tubular).

The Hostalen process was developed in 1965 and since then has become one of the leading low-pressure slurry cascade processes for the production of monomodal and bimodal polyethylene resin, including PE 100 pipe and high tenacity film grades. Approximately 3.5 million tons of capacity has been licensed (16+ plants in operation). Over 35% of the Hostalen capacity is centered in Asia and 25% in Europe. Demand for bimodal products in Europe and Asia, particularly pipe and film-grade resin, has been one of the main drivers for its success in recent years. PetroChina licensed Hostalen technology from Basell in 2004 and these will be the next two licenses.

LyondellBasell Industries to be the new company name for Basell and Lyondell

Basell and Lyondell Chemical Company jointly announced their plans for naming the company which will result from their planned merger. Following the completion of the merger transaction, the newly combined company will be named LyondellBasell Industries.

Lyondell announced on Sept. 25 that a special meeting of its shareholders has been scheduled for Tuesday, November 20 to vote on the proposal to adopt the Agreement and Plan of Merger, dated as of July 16, 2007, among Basell AF, BIL Acquisition Holdings Limited and Lyondell.

Both companies said that the LyondellBasell brand will be rolled out after the closure of the transaction, which is expected to take place in the fourth quarter of 2007.

Comments: The new organization had over 200 suggestions for the name both internally and externally. It was rumored – the companies even had an internal contest to pick a good name – The new name is LyondellBasell Industries.

Lyondell has the genealogy of Arco, Halcon, US Steel, Norchem Equistar, Millennium, etc., It was always credited in the past for coming up with new and thought-provoking names. Basell on the other hand has been the derivative of their parents (Montedison – Hercules to HIMONT; Shell and Montedison to Montell – BASF and Shell to Basell –

Maybe all the good names are already taken??? Just a trivial issue…,

Braskem confirms investment to produce 200 KT polyethylene from sugarcane

Braskem, the Brazilian petrochemical company confirmed their project for the implantation of a new production plant for polyethylene made from sugar can ethanol, to enter into operations at the end of 2009 and with a capacity of 200 KT per annum.

The first company to produce globally certified polyethylene made 100% from renewable raw materials; Braskem has already produced around 1,000 kg of the green polymer in its pilot plant, working at full capacity, in its Center of Technology and Innovation. To date, Braskem has brokered pre-contract sales orders with a variety of companies that are leaders in their segments of the international and Brazilian market, and who are interested in becoming partners regarding this technological breakthrough of a project that will have positive impacts on the environment.

The companies interested in realizing supply contracts with Braskem have already started to receive samples of the green polyethylene to keep the transformers and end users up to date. The production of plastics made from ethanol is aimed at supplying the main international markets that require products with superior quality and performance; most notably the automobile, food packaging, cosmetics, and personal hygiene industries. The product has the same physical properties as traditional polyethylene and requires no investments in new equipment for the manufacturers of plastics.

In addition to green polyethylene, Braskem is currently developing other projects aimed at the longer term and focused on biopolymers, such as polypropylene made from biomass.

Comments: After a recent wave of consolidation in Brazil’s chemical industry, Braskem is one of the dominant petrochemical producers in the region. After the Ipiranga acquisition, Braskem has a market share of over 50% in PE, PP, and PVC resins. These three resins account for more than half of Braskem’s revenues, and its strong market share in these resins highlights the company’s dominant market position in Brazilian petrochemicals.

The company is organized around three main business segments: polyolefins, vinyl, and basic petrochemicals: (1) The polyolefins segment consists of the polyethylene (PE) and polypropylene (PP) manufacturing units of Braskem and Ipiranga at the North Eastern and Southern petrochemical complexes. These units source the bulk of their ethylene and propylene requirements from the basic petrochemicals segment, (2) The vinyl segment consists of the company’s PVC and caustic/chlorine manufacturing units in the North Eastern complex, as well in Alagoas. Braskem is one of only two companies producing PVC in Brazil – Solvay Indupa is the other – and accounts for 66% of Brazil’s installed PVC production base, and (3) The basic petrochemicals unit consists of the ethylene crackers owned by Braskem and Copesul, as well as related aromatics capacity. This segment is well-integrated with the company’s polyolefins and vinyl units and is the primary raw-material supplier for both these divisions with more than 80% of the ethylene and 45% of the propylene produced being sold internally.

The company had previously announced its intention to commercialize the manufacture of polyethylene from ethanol and now has reaffirmed its decision. For more information, please refer to our Global PO&E – Strategic News Analysis, Volume 5, Issue 14.

Mitsui Chemicals Group plans to start a new polypropylene automotive materials company in India

Mitsui Chemicals, Inc and Prime Polymer Co., Ltd., an MCI subsidiary, announced that they had established a new company in India to meet the growing demand for polypropylene (PP) automotive materials in the country. The groundbreaking ceremony is scheduled for November 13, 2007.

The name of the new company will be Mitsui Prime Advanced Composite India PVT LTD which will be mainly involved in the manufacturing and sales of PP automotive materials. Mitsui will hold an 80% stake in the company and the rest will be owned by Prime Polymer. The manufacturing facility will be located in Neemrana, Rajasthan, and will start commercial operation in April 2009. The production capacity of the plant will be 15 KT per year.

The new company is the first business operation in India for the MCI Group, although the group has already opened a local office (Mitsui Chemicals Asia Pacific Ltd., Liaison Office in India) in February of this year. The Indian automobile market is showing strong expansion at 15% annual growth, with sales volume expected to reach 2.1 million units in 2010, jumping from 1.3 million in 2006. Against such background, Japanese automakers are strengthening local production capabilities, and therefore demand for PP automotive materials is expected to dramatically increase.

Comments: The automotive market in India has been growing at double-digit rates fueled by the growing consuming (middle) class and ease of financing. Growth in the automotive market has been stagnant in developed countries. Suppliers will have to look at emerging economies to capture the growth of automotive markets. Mitsui has a very good position in the automotive market and has been successful in providing impact PP in other Asian countries. The current move will be beneficial to both Mitsui and India; India will gain the expertise of an established player such as Mitsui while Mitsui will gain access to a growing automotive market. Raw material should not be an issue as there is a significant new polypropylene capacity being planned in India.

The Indian petrochemical industry has seen significant investments in cracker and derivative units. There is also significant demand on the consumer side due to the growing economy. Converting industry has been a major bottleneck preventing the growth of the Indian petrochemical industry. In the next few years, we anticipate more foreign direct investment in the converting industry in India.

CMR, Inc analysis indicates that ethane prices have decoupled from natural gas prices

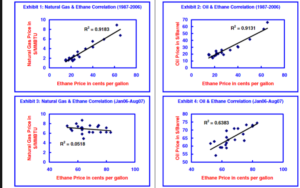

Historically ethane prices in the US have been linked to natural gas prices in the US. Exhibit 1 plots the natural gas and ethane prices between the years 1987 and 2006. The correlation between natural gas prices and ethane prices is 0.91 indicating a strong correlation. Exhibit 3 plots the natural gas price and ethane prices between Jan 2006 and August 2007. The correlation between the two is 0.051 indicating little to no correlation. Exhibit 4 plots the oil prices and ethane prices between Jan 2006 and August 2007.

The correlation between the two is 0.65 indicating a better correlation between oil prices and ethane than between natural gas prices and ethane. This indicates that in recent times ethane prices in the US have been based on the higher naphtha price and not natural gas prices. The current trend seems to suggest that the pricing mechanism is still based on the highest-cost producer or feedstock. We anticipate this trend to continue at the beginning of the next decade as well.

Please refer to the exhibits below.

DuPont Liquid Packaging Systems to sell performance films segment and Whitby operating facility

DuPont Liquid Packaging Systems, also known as Liqui-Box, today announced a definitive agreement to sell its performance films business segment (encompassing the Sclairfilm® and Dartek® operations) and its Whitby, Ontario, operating facility to Exopack Performance Films Inc. (“Exopack”), an affiliate of Sun Capital Partners, Inc., a leading private investment firm located in Boca Raton, Florida. The transaction is expected to close in November 2007, subject to regulatory approval. Terms of the transaction were not disclosed.

The performance film operations focus on the production of Dartek® nylon 6,6 cast film, a high-quality barrier film, and the Sclairfilm® family of premium sealant films. These products are manufactured at the Whitby facility and used in a variety of packaging and industrial applications. As part of the sale, DuPont Liquid Packaging Systems is entering into a long-term supply agreement with Exopack for films and laminates produced at the Whitby site that is used in its liquid packaging systems business.

Under the terms of the sale, Exopack will offer employment to all employees involved in the Whitby site operations including poly, nylon, finishing, laminations, and manufacturing support, as well as sales and sales support for the Sclairfilm® and Dartek® businesses.

Headquartered in Spartanburg, SC, Exopack is a full-service paper and plastic flexible packaging solutions manufacturer that specializes in substrate development, film extrusion, printing, lamination, and conversion of flexible packaging products. In addition, their newly-acquired coatings division is known for its advanced film coating technologies. Products manufactured by Exopack include microwave packaging, printed collation shrink films, laminated FFS materials, specialty bags and pouches, heavy-duty shipping sacks, medical components, and optical and electronic films.

DuPont Liquid Packaging Systems is a leading global supplier of flexible packaging systems to the liquid food and beverage industries with sales and manufacturing sites in North America, Europe, India, Latin America, and Asia Pacific.

Currently managing seventeen production facilities strategically positioned across North America and the United Kingdom, as well as a global network of alliance partners, Exopack is an established leader in the development, manufacture, and sourcing of paper and plastic flexible solutions for various consumer and industrial end-use markets. Both Exopack Holding Corp. and Exopack Performance Films Inc. are affiliate companies of Sun Capital Partners, Inc.

Comments: DuPont Liquid Packaging Systems (DLPS) is a division of E. I. du Pont Canada. The Company makes bag-in-box packaging for beverages that include carbonated and dairy drinks, juices, water, and wine. Other end-use markets include processed foods, specialty chemicals, food oils, and medical supplies. DLPS also makes blow-molded containers, injection-molded plastics, and plastic packaging films, along with the equipment needed to fill its containers. Exopack is one of the largest flexible packaging converters in North America with 14 strategically located North America manufacturing facilities. Exopack caters to markets such as pet food packaging, lawn, and garden, cement, agricultural and chemical industries.

The flexible packaging market is growing at close to 4.5% in North America and is expected to continue for the next 5 years. The growth rate is attributed to the increase in demand for convenience-oriented food products. The sale will allow DuPont to focus on its core business in dairy, liquid food, and beverage packaging systems and expand Exopack’s product portfolio in flexible packaging.

Bemis and Plantic to jointly develop flexible packaging based on biopolymers

Bemis Company, Inc. announced that it will partner with Plantic Technologies Limited, an Australian company specializing in starch-based biopolymers, to develop and sell renewably resourced flexible films using patented Plantic® technology.

The alliance between the two companies will result in the co-development of new flexible packaging materials based on Plantic® bioplastic resin developed using high-amylose corn starch for use as a component of or as a stand-alone structure in flexible packaging products. Targeted applications for the new films will include flexible packaging for personal care and dry goods.

This agreement also enhances existing efforts by the Bemis Company to provide sustainable solutions throughout the entire lifecycle of packaging materials by increasing in-plant processing speeds, reducing packaging bulk, reducing shipping weight, improving efficiency throughout the distribution system, and ensuring food safety.

Under the agreement Bemis and Plantic will collaborate in the joint development of various resins which can be blown into packaging and functional films for use in the Americas.

Bemis Company is a major supplier of flexible packaging and pressure-sensitive materials used by leading food, consumer products, manufacturing, and other companies worldwide. Founded in 1858, the Company reported 2006 net sales of $3.6 billion. The Company’s flexible packaging business has a strong technical base in polymer chemistry, film extrusion, coating and laminating, printing, and converting. The Company’s pressure-sensitive materials business specializes in adhesive technologies.

Plantic Technologies Limited is based in Australia, where its head office, principal manufacturing, and research and development facilities are located. The company also has sales offices in Germany and the United Kingdom, employing approximately 50 people internationally. Plantic Technologies has emerged as a world-leading bioplastics innovator. The company has won numerous international awards for achievement in science and has built an international network of major corporate customers, distributors, and research and development partners.

Comments: Bemis Company, Inc. is an international manufacturer of flexible packaging products and pressure-sensitive materials. The flexible packaging segment accounts for over 80% of the Company’s revenues and serves both consumer and industrial markets through its high barrier and polyethylene products, and a smaller line of paper products. The primary end market is the food industry; other markets include chemical, medical, pharmaceutical, and personal care. The pressure-sensitive segment supplies both the consumer and industrial markets. Pressure-sensitive materials are used for labels, graphics, and technical products.

With high dependence on polymers and participation in markets such as personal care, pharma, and medical, the company will gain an advantage through such an alliance with Plantic Technologies.

PetroChina’s IPO gained huge success making the company world’s biggest oil company

Shares in PetroChina more than doubled in their market debut on Monday after it raised $9 billion in the world’s biggest IPO this year, surging past analysts’ expectations as crude prices neared $100.

China’s top oil producer became the world’s biggest listed company by market value at around $1 trillion, double the capitalization of the second biggest company Exxon Mobil, at $488 billion.

Government-controlled PetroChina closed at 43.96 yuan in Shanghai, up 163 percent from its IPO price and far above analysts’ forecasts of around 35 yuan. But the massive demand for PetroChina shares was partly due to wild speculation that has gripped China’s stock market during a bull run that began last year.

PetroChina raised 66.8 billion yuan ($9 billion) in Shanghai by selling 4 billion shares, or 2.18 percent of its expanded share capital, in the domestic Chinese market’s biggest initial public offer. Proceeds are being used for five domestic projects to develop oilfields and expand ethylene output, as well as to supplement working capital.

PetroChina’s turnover of $53 billion in the first half of this year lagged far behind Exxon’s $179 billion and its net profit of $12 billion was below Exxon’s $20 billion.

Comments: PetroChina Company Limited (PetroChina) is engaged in the exploration, production, refining, marketing, transportation, and distribution of oil and natural gas. PetroChina is a subsidiary of the state-owned China National Petroleum Corporation (CNPC). PetroChina produces two-thirds of China’s oil and gas. The company principally operates in China. It is headquartered in Beijing, China, and employs about 439,200 people. PetroChina is a vertically integrated oil and natural gas company based in Beijing, China. PetroChina is one of the largest companies in China in terms of sales.

The company’s key products and services include the following: (1) refined products (diesel, gasoline, fuel oil, naphtha, jet fuel, lubricants, asphalt, paraffin), (2) chemical products – basic petrochemicals (ethylene, propylene, benzene), derivative petrochemicals – polyolefin (polyethylene, polypropylene, ABS), Intermediates (PTA, glacial acetic acid, alkylbenzene, octanol, synthesized ethanol, buty alcohol, purified methanol), fibers (terylene fiber, polyacrylic fiber, polypropylene fiber), rubber (butadiene-styrene rubber, polybutadiene rubber, acrylonitrile-butadiene rubber, ethylene-propylene rubber) and other chemicals (urea, ammonium nitrate).

Further cost-structure measures to be implemented at Bayer MaterialScience

Bayer MaterialScience announced its plans to initiate further cost-structure measures to sustainably strengthen its earning power. The measures are designed to help save EUR 300 million annually by the end of 2009. To this end, it is planned to achieve further process and cost optimization in the operation and maintenance of production facilities worldwide. The company expects that total special charges of EUR 150 million to EUR 200 million through 2009 will be necessary to achieve these savings.

Bayer MaterialScience also intends to significantly lower administration, marketing, and distribution costs. Bayer MaterialScience anticipates that the headcount reduction necessitated by the measures can be accomplished in a socially compatible way and through normal attrition.

Comments: In 2003, Bayer reorganized its business and combined its polymers and chemicals units into one division MaterialScience. Bayer MaterialScience could be eventually divested by Bayer as the company’s main focus is on healthcare and life sciences.

Carmel Olefins to expand in Europe

Carmel Olefins Ltd. has signed a memorandum of understanding (MOU) with a European company to acquire 49% of a petrochemical company for EUR20 million. The names of the companies were not disclosed. Carmel Olefins might also pay an up to additional EUR1 million a year for five years beginning in 2013, in accordance with a mechanism and terms in the MOU.

Comments: Carmel Olefins Ltd. is Israel’s only producer of polyethylene and polypropylene. Carmel manufactures standard and special grades of Polypropylene (PP) as well as a broad range of Low-Density Polyethylene (LDPE) grades.

Carmel Olefins Ltd. was founded in 1991 through a merger of existing businesses and is now a private company jointly owned by the Israel Petrochemical Enterprises Ltd. and by the Oil Refineries Ltd. Carmel’s production and management center is in the Haifa Bay industrial zone, adjacent to the refinery. Carmel Olefins Ltd. manufactures and sells 165 kTPA Low-Density Polyethylene (LDPE) under the name Ipethene®. A broad range of Ipethene® products have been produced since 1964 (formerly by Israel Petrochemical Enterprises Ltd.), and there are now four lines consisting of high-pressure autoclave reactors. Carmel Olefins produces 450 kTPA PP under the name Capilene®. The large range of Capilene® PP products is manufactured in two production lines based on Spheripol and Spherizone technology under license from Basell.

Carmel Olefins Ltd. operates its steam cracker that supplies 240 kTPA ethylene, and 135 kTPA propylene; The metathesis plant supplies 180 kTPA propylene. Primary raw materials such as naphtha and liquefied petroleum gas are sourced via pipeline from the adjacent oil refinery.

Target to phase out products with PVC from stores

Target Corp., the fifth largest retailer in the United States, announced its plans to reduce the number of products containing PVC on its shelves in a gradual switch to products that do not contain the controversial compound.

The nationwide chain joins other major companies such as Wal-Mart, Microsoft, Johnson & Johnson, Nike, and Apple, which have decided to remove products that contain PVC from their shelves.

At Target, PVC products will be replaced with others made from a range of other materials, including ethylene vinyl acetate, a non-PVC plastic.

The planned move away from PVC for the retailer, which earns $59 billion in revenues annually, was first announced earlier this week by the environmental group, Center for Health, Environment and Justice in Washington, D.C. The phase-out of PVC involves a wide range of merchandise from infant products, children’s toys, shower curtains, and fashion accessories to the packaging in which numerous products are contained.

Comments: This type of announcement is not new to the PVC industry. More and more retailers have made this announcement but there is little to no impact on demand for PVC.

Contact us at ADI Chemical Market Resources to learn how we can help.