My Turn – Commentary by Dr. Balaji B. Singh

We look forward to seeing you at this year’s FlexPO2006. We have selected the best topics/best speakers in an organized fashion – Some good reasons to attend Flexpo2006 in Houston, Sept 20-22, 2006 – Just see the program.

Polyolefin producers announce 2ndquarter earnings

Dow Chemical

Dow Chemical Company reported sales of $12.5 billion for the second quarter of 2006, a new quarterly record and 9 percent higher than the same period in 2005.

Net income for the quarter was $1,023 million, 19% lower than in 2005, while earnings per share fell from $1.30 in 2005 to $1.05 in 2006. Earnings for the second quarter of 2005 included a benefit of $0.12 per share related to the repatriation of foreign earnings and a charge of $0.02 per share associated with the Company’s early redemption of debt.

Compared to 2005, volume for the quarter increased by 4 percent, with strong volume growth in Latin America and Asia Pacific, combined with good demand in Europe, more than offsetting a modest decline in North America. Price also edged higher, reflecting healthy increases in most of the Company’s Basics businesses, dampened by weaker price momentum across much of the Performance sector. The resulting 5 percent year-over-year price improvement was not enough to counter another significant increase in feedstock and energy costs, which climbed more than $800 million compared with the second quarter last year causing margin erosion in our Performance segments.

In the Performance Plastics segment, sales for the second quarter were $3.44 billion, an increase of 13 percent compared with the same period in 2005. Volume rose 11 percent, with strong demand in Asia Pacific and Europe, while the price increased 2 percent – not enough to offset the higher feedstock costs. Polyurethanes and Thermoset Systems reported increases in both price and volume, with continued growth in the Company’s value-added Systems House business and better industry fundamentals in toluene diisocyanate. Dow Epoxy reported a healthy year-over-year improvement in volume, led by double-digit volume growth in Europe – with strong demand for civil engineering applications – and in Asia Pacific, where sales into coatings applications were particularly robust. Dow Building Solutions also recorded volume growth, as heightened demand from the U.S. commercial construction industry offset a drop in new housing starts, and European construction picked up strongly after a slow first quarter caused by unusually harsh winter weather. Dow Automotive reported lower volume compared with the same quarter a year ago, principally the result of reduced industry builds in North America. EBIT for Performance Plastics was $412 million, down 17 percent compared with $498 million in the same quarter last year.

Sales in the Performance Chemicals segment were $1.97 billion for the second quarter of 2006, 5 percent higher than the $1.88 billion in the same period last year. Volume increased 6 percent year-over-year, but price declined 1 percent, as several businesses struggled to offset the significantly higher raw material costs. Specialty Chemicals posted improvements in both price and volume compared with the same quarter a year ago, with glycol ethers seeing significant sales growth in Asia Pacific, and amines reporting solid demand for wood treatment applications. EBIT for Performance Chemicals was $362 million for the quarter, 11 percent lower than the $406 million reported in the same period last year.

Nova Chemicals

NOVA Chemicals reported a net income of $108 million ($1.30 per share diluted) for the second quarter of 2006. The second quarter’s net income compares to a net loss of $5 million ($0.06 per share) for the first quarter of 2006 and a net loss of $25 million ($0.29 per share) for the second quarter of 2005.

The Olefins/Polyolefins business unit reported a net income of $151 million in the second quarter of 2006 compared to a net income of $70 million in the first quarter. Margins improved as lower prices were more than offset by lower feedstock costs. Volume was up mainly due to the first-quarter impact of the extended Corunna outage.

USGC ethylene benchmark prices averaged 47¢ per pound in the second quarter of 2006 compared to 50¢ per pound in the first quarter. The Alberta Advantage averaged 14¢ per pound of cash cost of ethylene production in the second quarter of 2006, up significantly from 5¢ per pound in the first quarter.

The advantage strengthened as NOVA Chemicals’ ethane costs decreased by 16%, while ethane prices on the USGC increased by 19%. USGC ethane prices rose due to strong demand for ethane feedstock, resulting from high USGC ethylene operating rates as well as the rapid increase in the costs of alternative feeds. In July, the Alberta Advantage was widened further to approximately 20¢ per pound. Alberta-advantaged ethylene is used to produce approximately 65% of NOVA Chemicals’ total polyethylene.

NOVA Chemicals’ total polyethylene sales volume for the second quarter was 837 million pounds, up 100 million pounds from the previous quarter, mainly reflecting increased ethylene availability from Corunna. International sales volumes decreased 7% quarter-over-quarter to 95 million pounds primarily due to a focus on improved domestic sales and margin opportunities. International sales represented 11% of total polyethylene sales in the second quarter.

North American polyethylene demand exceeded supply in the second quarter even though producer operating rates averaged 92%.

Westlake Chemical

Westlake Chemical reported net income of $67.2 million, or $1.03 per diluted share, for the second quarter of 2006, an increase of 39% from the second quarter of 2005 net income of $48.5 million, or $0.74 per diluted share. Income from operations was $106.9 million on net sales of $669.3 million for the second quarter of 2006. The improvement in income from operations was primarily the result of increased selling prices, which outpaced higher feedstock costs.

Second quarter results were positively impacted by the utilization of first-in, first-out (FIFO) inventory accounting as compared with utilizing the last-in, first-out (LIFO) method used by some companies in the industry as a result of rising feedstock costs.

The second quarter of 2006 net income increased by $15.9 million, from the $51.3 million net income, or $0.79 per diluted share, reported in the first quarter of 2006. Second quarter of 2006 income from operations decreased by $4.0 million from the income from operations of $110.9 million reported in the first quarter of 2006, while net sales increased by $50.5 million from the $618.8 million reported in the first quarter of 2006. The decrease in income from operations was due to a planned outage for maintenance turnaround at the Company’s vinyl complex in Calvert City, Kentucky which was completed in the second quarter, and lower operating margins in the Company’s vinyl segment due to higher feedstock costs and lower average selling prices. The increase in sales was primarily due to higher sales volumes for the Company’s major products.

OLEFINS SEGMENT

Income from operations for the Olefins segment increased by $30.0 million, or 94%, to $62.0 million in the second quarter of 2006 from $32.0 million in the second quarter of 2005. This increase was primarily due to higher selling prices for all of the Company’s major products and higher sales volumes for polyethylene. These increases were partially offset by lower sales volumes for ethylene and styrene and higher feedstock costs. Merchant ethylene sales volumes were lower for the second quarter of 2006 as compared to the second quarter of 2005 largely due to the increase in internal ethylene consumption at our Geismar vinyl facility.

In the second quarter of 2006 income from operations for the Olefins segment increased by $2.4 million from the $59.6 million income from operations reported in the first quarter of 2006. This increase was primarily due to higher sales volumes and lower natural gas costs.

Income from operations for the Olefins segment increased by $27.2 million, or 29%, to $121.6 million for the six months ended June 30, 2006, from $94.4 million for the six months ended June 30, 2005.

VINYL SEGMENT

Income from operations for the vinyl segment decreased by $6.7 million to $44.3 million in the second quarter of 2006 from $51.0 million in the second quarter of 2005. This decrease was primarily due to a planned outage for maintenance turnaround at the Company’s vinyl complex in Calvert City, Kentucky which was completed in the second quarter. Higher selling prices for most of the Company’s vinyl products and higher sales volumes for PVC resin and PVC pipe were more than offset by lower sales volumes and prices for VCM and increased raw material costs.

Second quarter income from operations for the vinyl segment decreased by $10.1 million from the $54.4 million income from operations reported in the first quarter of 2006. This decrease was primarily due to the outage for a planned maintenance turnaround at the Company’s vinyl complex in Calvert City, Kentucky, lower selling prices for VCM, PVC resin, and PVC pipe, and higher feedstock costs. These decreases were partially offset by higher sales volumes and lower natural gas costs.

Income from operations for the vinyl segment increased by $6.1 million, or 7%, to $98.7 million for the six months ended June 30, 2006, from $92.6 million for the six months ended June 30, 2005. This increase was primarily due to higher selling prices for PVC resin and PVC pipe and higher sales volumes for PVC resin.

ExxonMobil

ExxonMobil Corporation reported a net income of $10,360 million ($1.72 per share) for the second quarter of 2006, an increase of $2,720 million from the second quarter of 2005. First half net income of $18,760 million ($3.09 per share), increased by 21% versus the first half of 2005.

Downstream earnings excluding special items, were $2,485 million, up $264 million from the second quarter of 2005. The improved results reflect stronger worldwide refining margins, which were partly offset by weaker marketing margins and lower refining throughput. Petroleum product sales were 7,060 kbd, 450 kbd lower than last year’s second quarter, primarily due to lower refining throughput associated with planned maintenance and divestments.

U.S. Downstream earnings were $1,354 million, up $155 million. Non-U.S. Downstream earnings of $1,131 million were $109 million higher than in the second quarter of 2005.

Chemical earnings were $840 million, up $26 million from the second quarter of 2005. Prime product sales of 6,855 kt (thousands of metric tons) were up 263 kt from last year’s second quarter due to stronger commodity sales.

DuPont

DuPont reported second-quarter 2006 earnings of $1.04 per share. Consolidated net income for the second quarter was $975 million, or $1.04 per share compared to the second quarter 2005 net income of $1,015 million, or $1.01 per share. Excluding significant items, earnings per share were $1.01 in the second quarter of 2006 compared to $.90 in the prior year. See Schedule B for a summary of significant items.

Second quarter 2006 net income reflects higher local selling prices across all regions, lower fixed costs, and the impact of higher energy and ingredient costs. Consolidated net sales for the second quarter were $7.4 billion versus $7.5 billion last year. On a comparable business basis, sales were up 2 percent. For the quarter, total company volumes increased by 1 percent, reflecting increases in all regions except the United States.

Performance Materials PTOI was $193 million versus $190 million in 2005. Higher selling prices, increased volumes, and lower fixed costs more than offset significantly higher raw material costs, a negative currency impact, and the absence of earnings from businesses transferred to The Dow Chemical Company. PTOI margins increased to 11.1%. Second-quarter sales of $1.7 billion increased by 6 percent on a comparable business basis. Sales increased in all regions and volume growth was strong in most market segments.

Safety & Protection PTOI was $310 million versus $283 million in the prior year, largely as a result of sales growth across all business units while holding fixed costs flat. PTOI margins increased to 21.6%. Second-quarter sales of $1.4 billion were up 3 percent, reflecting higher USD prices. Demand remained firm across major markets such as construction, electrical, industrial, and medical.

Basell to build new Spherilene polyethylene plant at Wesseling, Germany

Basell announced today that it plans to build a new Spherilene S polyethylene plant at its Wesseling industrial site near Cologne, Germany. The plant will be based on Basell’s new Spherilene S single reactor gas phase design. The start-up is planned for 2008.

Basell currently operates an 80 KT Lupotech G polyethylene plant at Wesseling. This plant will be converted into a new Spherilene S plant based on the latest generation technology including the installation of a new reactor system.

“The new Spherilene S process features low investment and operating costs, high on-stream factors, and monomer efficiency,” said Just Jansz, president of Basell’s Technology Business. “Spherilene S plants also have true swing capability between HDPE and LLDPE since both products can be produced from the same Ziegler catalyst family.”

Basell’s new Spherilene technology can be designed in a single reactor configuration (Spherilene S) or with two gas phase reactors in series (Spherilene C) for the production of bimodal grades.

Spherilene S technology is designed to produce products with narrow and medium molecular weight distribution. Both butene and hexene-modified LLDPE can be produced as well as HDPE.

Comments: Spherilene is a multi-reactor, fluidized bed process for producing polyethylenes. In 1990 Himont embarked on an effort to design a polyethylene process based on the extensive experience it had garnered during the development of the very popular Spheripol process, announcing it had perfected the process in 1993, calling it Spherilene. Taking another cue from its polypropylene technology, Himont designed a catalyst for the process based on concepts from its Reactor Granule Technology which imparts a spherical morphology to the final product.

The process is designed to produce products ranging from VLDPEs (0.900 g/cc) to HDPE (0.962 g/cc). Unlike other LLDPE/HDPE gas-phase processes, Spherilene is more complex with its multiple reactor design.

Basell has combined its polyethylene license portfolio and now offers one gas phase process for the entire PE product range. Basell’s new Spherilene technology can be designed in a single reactor configuration (Spherilene S) or with two gas phase reactors in series (Spherilene C) for the production of bimodal grades. The company has been offering its licensors a similar opportunity of converting the Lupotech G plant to the Spherilene plant.

Innovate to offer contract research services using high-throughput capabilities from Symyx Technologies

CID announces new contract research services for short-term, proof of principle polymer synthesis and screening projects using high-throughput capabilities purchased and licensed from Symyx Technologies, Inc. Complementing equipment and facilities that CID presently offers, CID has purchased parallel pressure reactor instrumentation and licensed Symyx Software and certain intellectual property from Symyx to be able to provide such research services to customers. CID delivers results at a fraction of the cost and in a fraction of the time required for traditional research and development.

The services will be marketed through Innovante Corporation under an agreement with Chemical Market Resources, Inc.

CID, Centro de Investigacion y Desarrollo Tecnologico S.A. de C.V., is the research and development arm of DESC S.A. de C.V. of Mexico, a diversified company with extensive holdings in the chemical industry. While previously a captive research and development company for DESC affiliates, in recent years CID began to offer research and development services to unaffiliated companies using its state-of-the-art facilities and equipment under the direction of its team of renowned scientists and engineers.

CMR is a Texas-based company focused on providing clients with thoroughly researched market studies emphasizing emerging trends in the industry, changes in technology supporting these trends, and strategic direction assessment so that its clients can Another Unique Service From Chemical Market Resources, Inc. 560 Blossom Street, Ste C, Houston, TX 77598 USA; Tel: 281-557-3320 Email: POE-SNA@CMRHouTex.Com Copyright © 2006 Page 7/22of Issue 16 – Volume 4 optimize opportunities in specific markets by providing in-depth research combined with thorough analysis in a cost-effective and timely fashion.

Comments: By acquiring these advanced HTPT capabilities that complement its state-of-the-art R/D facilities in place already, CID is positioning itself as a top-notch competitive R/D service provider to its current and future customers around the world. These services are currently marketed through Innovante Corporation under an agreement with CMR Inc., Houston, TX. This alliance has created an industry-leading initiative for market-driven R/D and product development. With the unified two decades of technology/market development of CMR Inc., & CID, the Innovante Corporation has the ability and resources to provide the best all-around solutions to “low cost/high quality” R/D without compromising the intellectual property assets.

By providing a risk-free collaboration – 100% ownership of IP and commercial success to its customers with an enviable track record of a 12X rate of investment, the Innovante platform services are indeed a value proposition for a changing environment.

For further information and collaboration, please contact us at 281-557-3320. Also visit: www.cmrhoutex.com, www.innovanteresearch.com, www.innovanteresearch.com.mx www.innovante.com.mx.

Sinopec to construct 450 KT PP plant using Spherizone technology

Sinopec Tianjin Petrochemical Company announced the selection of Basell’s Spherizone technology for a new 450 KT per year polypropylene plant to be built at Dagang, Tianjin in the People’s Republic of China. The start-up is planned for 2009.

The Tianjin plant will be the eighth to be built using Spherizone technology. About 2.5 million tons of capacity has already been licensed, including three new Spherizone process licenses in the past two months.

Spherizone technology is an advanced manufacturing process for the production of polypropylene that uses a unique, state-of-the-art, multi-zone circulating reactor system. Spherizone process plants can produce the full range of polypropylene grades and new families of propylene-based polymers.

Comments: Tianjin and the Bohai Sea Rim area are planned to become one of the three largest industry zones for China’s ethylene industry, according to the Chinese Government’s 11th Five-Year Plan (2006-2010). The other two industry zones are the Yangzi River Delta (Shanghai, Nanjing, and nearby area) and the Zhu River Delta (Guangdong and nearby area). The State Council approved Sinpec’s one million-ton ethylene cracker project at the end of 2005. A proposal for a similar-sized ethylene cracker project by PetroChina is under review and is likely to be approved by the Government. In the coming issue of New Generation Polypolyolefins (NGP), we are publishing a full translation with comments on “The Medium and Long Term Planning for the Ethylene Industry” recently released by the Chinese government.

For the last decade, China has had a large supply/demand gap that was being filled by the import. Domestic players focus on running at full capacity to produce commodity grades. As these players expand capacity, they are also starting to focus on upgrading their technology for differentiated and specialty grades. The licensing of this Spherizone technology is a good example. Another example is last year’s license by PetroChina Dushanzi of the Unipol process including metallocene LLDPE and single reactor bimodal PE.

Basell to construct new Hostalen ACP HDPE plant at Muenchsmuenster, Germany

Basell announced its plans to build a new Hostalen Advanced Cascade Process (ACP) high-density polyethylene (HDPE) plant at the Muenchsmuenster industrial site near Munich, Germany. Basell’s first-generation Hostalen process plant at Muenchsmuenster was damaged by an explosion and fire in December 2005.

Subject to the necessary approvals, there will be a complete rebuild of the damaged 120 KT polymerization unit based on the latest generation Hostalen ACP technology as well as a new extrusion unit. The start-up is planned for the beginning of 2009. The plant design will accommodate future expansion to 150 KT.

According to the company, Basell’s new Hostalen ACP technology can produce high-performance multi-modal HDPE. These grades offer advantages in demanding customer applications such as high-pressure pipes, caps & closures, blow molding, and specialty film.

Comments: Hoechst was the first producer of HDPE, using a predecessor to the modern Hostalen process that was developed by Hoechst and inherited by Elenac then by Basell.

Hostalen with an estimated capacity of over 2,100 KT has its largest installed capacity base in Asia-Pacific (35%), Europe (23%), and South America (22%). The least successful region has been Japan. Hostalen process offers a proven HDPE grade slate and competitive film, pipe, and blow molding grades. The process is widely known for its high-quality bimodal HDPE products. This new facility will have the Hostalen Advanced Cascade Process (ACP) that has the capability to produce multi-modal HDPE. Basell launched new HDPE grades based on the Hostalen ACP in 2005.

Basell sells its stake in Taiwan Polypropylene Company to Lee Chang Yung

Basell announced that it has agreed to sell its 36% share in Taiwan Polypropylene Company Ltd (TPP) to Lee Chang Yung Chemical Industry Corporation of Taiwan. In conjunction with the sale, Basell will acquire all shares currently held by TPP in other Basell joint ventures in the region: SunAllomer in Japan (16.7%), PolyMirae in South Korea (10%), and HMC Polymers Company in Thailand (5%).

The transactions are expected to be completed in August. According to Basell, this move is consistent with Basell’s strategic intent to focus on areas where we have built advantaged feedstock positions.

Lee Chang Yung Chemical Industry Corporation is a leading global thermoplastic elastomer manufacturer. Established in 1966, its head office is in Taipei City.

Comments: Basell is continuing to reorganize its assets after its divestiture from parents BASF and Shell. The new company was anticipated to reorganize its assets to improve its feedstock position. We believe Basell will continue to make strategic changes in its asset portfolio.

Taiwan Polypropylene Company has 401 KT of polypropylene capacity at its Ta Sheh facility. Basell owned a 35% stake in this facility. The remaining was public (49%) and Koo Group (16%).

This seems more of a reorganization/swap. The current and new stakes for Basell after this deal are provided below:

Repsol to invest in Sines petrochemical complex in Portugal

Repsol YPF announced its plans to double the capacity of its Sines complex in Portugal at a cost of more than EUR600 million in a project to be completed by 2010.

The Spanish group plans three new plants and a 40% increase in cracker capacity at the operation which it acquired from Borealis in 2004. New plants for linear low-density polyethylene and polypropylene will be built under a strategy to provide a fully integrated facility. At present, 30% of ethylene and all the propylene made at the cracker, on the Portuguese coast, are exported.

When the investment is completed, the complex will have a production capacity of one million tpa of olefins and a similar volume of polyolefins. The current Sines capacities are 350 000tpa of ethylene, 145 000tpa of LDPE, and 130 000tpa of HDPE.

Comments: Repsol YPF has chemicals and petrochemicals presence in Spain (Tarragona and Puertollano complexes), Argentina (La Plata, Bahía Blanca, and Plaza Huincul), and Portugal (Sines complex).

Repsol has three ethylene facilities in Europe including Sines, Tarragona, and Puertollano. The total ethylene capacity of the three amounts to 1.3 million tons. Repsol ranked number 8th in ethylene capacity in Europe in 2005, and they are expected to rise to number 6 once these expansions are completed in 2009.

BASF renames Engelhard’s catalysts business

BASF announced that an important step in the integration process of Engelhard into the BASF Group has been accomplished with the registration of a new corporate name – BASF Catalysts LLC – in the United States. BASF will extend its brand to Engelhard companies in other regions of the world within the next months based on local registration requirements.

According to the company, the rebranding signifies a key milestone in the integration process as it brings together BASF’s brand strength and Engelhard’s strong reputation for innovation and quality.

Engelhard businesses not included in the Catalysts division will also operate under this new corporate entity until plans are finalized for the businesses in Appearance and Performance Technologies and Ventures to be transferred to other existing BASF business units.

Comments: This move by BASF is part of the integration process of Engelhard’s businesses within the organization. The name change should not affect any of its operations. BASF acquired Engelhard’s business in April 2006 after long negotiations.

Engelhard participates in various catalysts markets including (1) Environmental Catalysts – emission control catalysts, (2) Petrochemical & Refinery Catalysts – cracking catalysts, mineral adsorbents, and polymer catalysts.

Engelhard plays an important role in the polyolefins industry, serving as a toll producer as well as a third-party supplier of proprietary Ziegler-Natta catalysts for polyethylene and polypropylene. Polyolefins catalyst offerings include but are not limited to, (1) Lynx series for PP, (2) Lynx series for PE, (3) CD series for Innovene’s PP process, and (3) PTK series for Novolen PP technology. They have also worked with Borealis to scale up its BC-1 catalyst for the Borstar process.

Shell decides to construct a world-scale integrated petrochemicals complex in Singapore

Shell Eastern Petroleum (Pte) Ltd (“SEPL) announced its decision to proceed with the construction of a new world-scale ethylene cracker on Bukom Island, Singapore. Named Shell Eastern Petrochemicals Complex (SEPC), the integrated refinery and petrochemicals project will also include modifications and additions to the Bukom refinery and a new world-scale Mono-Ethylene Glycol (MEG) plant utilizing Shell’s proprietary technology on Jurong Island.

Detailed engineering design and procurement work is progressing well with construction on the ethylene cracker due to begin later this year and start-up of the new and modified facilities anticipated by 2009/ 2010.

The cracker and the new MEG plant will create an advantaged site through full integration with the Bukom refinery enabling feedstock and operating benefits. The 800,000 tons per annum-cracker will be ideally positioned to supply cracker products to the new 750,000 tons-per-annum MEG plant, planned and existing joint venture derivatives plants, and major customers on Jurong Island via existing undersea pipelines. The majority of MEG production is expected to be consumed in the region where there is considerable demand growth expected.

Comments: Shell has been operating on Jurong Island for a long time now. Jurong Island offers all the required facilities and services for chemicals and petrochemicals manufacturing and logistics. Moreover, Singapore is well placed geographically for distribution to the rest of Asia. Other advantages of the country include political and economic stability.

For more information on Jurong Island, please refer to our article in our bimonthly publication, New Generation Polyolefins.

Qatar and Shell launched the integrated Pearl GTL project

Qatar Petroleum and Royal Dutch Shell plc announced the launch of the world-scale integrated Pearl Gas to Liquids (GTL) project in Qatar.

The Pearl GTL project includes the development of offshore natural gas resources in Qatar’s North Field, transporting and processing the gas to extract natural gas liquids and ethane, and the conversion of the remaining gas into clean liquid hydrocarbon products through the construction of the world’s largest integrated GTL complex in Ras Laffan Industrial City.

Upstream, some 1.6 billion cubic feet per day of wellhead gas will be produced from the North Field and transported and processed to produce approximately 120,000 barrels of oil equivalent per day of condensate, liquefied petroleum gas, and ethane. The North Field is considered to be the largest single non-associated gas reservoir in the world with estimated recoverable resources in excess of 900 trillion cubic feet. Over its lifetime the integrated project will produce upstream resources of approximately 3 billion barrels of oil equivalent.

Downstream, dry gas will be used as feedstock for a new onshore integrated GTL complex which will manufacture an additional 140,000 barrels per day of liquid hydrocarbon products. The Pearl GTL complex will consist of two 70,000 b/d GTL trains and associated facilities. The plant will produce a range of clean liquid products and fuels, comprising naphtha, GTL fuel, normal paraffins, kerosene, and lubricant base oils.

The fully integrated Pearl GTL project is being developed under a Development and Production Sharing Agreement with the government of the State of Qatar, covering offshore and onshore costs, with Shell providing 100 per cent of project funding. Production from the first Pearl GTL train is anticipated to begin around the end of the decade, with the start-up of the second train following within a year.

Comments: Gas to Liquids refers to the conversion of natural gas into high-value commodity liquid fuels (including methanol, dimethyl ether (DME), and middle distillates), specialty chemicals, and waxes. GTL technology is capable of converting natural gas into clean products for use as fuels or chemical feedstock. GTL products are virtually pure paraffinic hydrocarbons that have excellent combustion properties and burn with a smooth, controlled flame. Also, unlike Compressed Natural Gas (CNG), GTL Fuel is compatible with existing diesel engines and distribution infrastructure, and therefore more cost-effective to introduce.

While the technology for producing each of these distinct products has been developed years ago, the GTL industry has made great strides only in the last decade. The key drivers for the GTL industry are (1) the recent technology advances, specifically in catalysts and numerous other components of GTL technology, which have significantly reduced capital costs, increased the selectivity with which the Fischer-Tropsch (FT) process can produce middle distillates and may have drastically reduced the scale at which GTL becomes economical; (2) the mounting pressure to reduce automotive emissions, and (3) the drive to monetize the plentiful remote gas reserves.

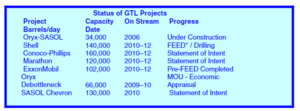

The key proponents considering the development of new commercial-scale GTL middle distillate plants include Shell, Sasol Chevron, ExxonMobil, Sasol, BP, Mossgas, PDVSA (Venezuela), and Sicor. Other companies are also known to be quietly considering possible GTL projects in Australia.

However, the potential of GTL technology is wider than middle distillate production. Several companies have recently announced plans to develop methanol and dimethyl ether (DME) projects using natural gas in either Western or Northern Australia. Recently, Methanex, GTL Resources Plc, and Mogal Marine P/L have announced their plans for Australian GTL projects.

Kraton Polymers to increase styrene block copolymers capacity in Europe

Kraton Polymers announced its plans to increase production capability for unhydrogenated styrenic block copolymers (USBCs) at its European plants. This 20 ktpa capacity increase is in response to rising demand from customers in a variety of global markets. Kraton is committed to providing world-class service to its customers, including having the capacity available to meet their future growth needs.

According to the company, it generates significant USBC capacity gains through low-cost de-bottlenecks. The successful incorporation of Lean Six Sigma techniques into our operations, coupled with the ability to leverage knowledge across our manufacturing facilities around the world has proven to be a powerful combination. The additional capacity is expected to come online by April 2007.

Comments: Kraton Polymers’ announcement of increasing their European capacity comes following Total Petrochemical’s announcement of closing down its elastomers plant at its Antwerp facility in Belgium.

The impending shortage in the supply of unsaturated SBC elastomers will be taken up by other producers in the region. The European producers of unsaturated SBC include Kraton Polymers, Polymeri Europa, and Dynasol, and imports from Asian producers. The European demand for SBS in 2005 was close to 560 million pounds growing at close to 4%

Nova Chemicals to close PS in Carrington, UK

NOVA Chemicals Corporation announced continued progress toward a target of $60 million per year in joint venture synergies by the end of 2007, with the announced closure of NOVA Innovene’s Carrington, UK, solid polystyrene facility. NOVA Chemicals will receive 50 percent of the benefit of total joint venture synergies.

The Carrington facility closure, announced today in a news release issued by NOVA Innovene, will remove approximately six percent of European solid polystyrene capacity and reduce NOVA Innovene’s fixed costs by approximately U.S. $14 million per year. Production at the Carrington solid polystyrene facility, which has a rated capacity of 396 million pounds (180 kilo tons) annually, is scheduled to cease in October 2006.

NOVA Chemicals will take a non-cash asset write-down of approximately U.S. $35 million after-tax in the third quarter of 2006 related to the facility closure. In addition, the joint venture will accrue an estimated U.S. $16 million in the third quarter for closure and severance costs, of which NOVA Chemicals’ share will be $8 million. In total, NOVA Chemicals will record a charge of approximately $43 million after tax in the third quarter of 2006.

Comments: Nova has been continuously organizing its polystyrene business to improve its competitiveness in styrenics. The company formed a joint venture with BP’s (now INEOS) polystyrene business which is now called Nova Innovene. The decision to close the Carrington plant is also part of this overall strategy.

The closure will reduce Nova Innovene’s European capacity by 25% and create a more balanced situation in an oversupplied market. The closure of the Carrington plant will reduce the company’s total annual PS capacity to 540,000 tons per year from 720,000 tons per year.

The other European manufacturing capacities for styrenics are located in Marl, Germany, Breda in the Netherlands, Trelleborg in Sweden, and Berre and Ribecourt, both in France.

New Cryovac® shrink film gains soft shrink & low shrink temperature with Topas® COC

Sealed Air Corporation has developed a film that shrinks easily with a low shrink force at temperatures as low as 150°F without compromising strength. The new shrink film, Cryovac® Xenith3™, also exhibits a high free shrink and provides a wide processing window. These benefits are due in great measure to the use of Topas® cyclic olefin copolymer (COC) in this multi-layer coextruded film.

Xenith3 shrink film, the latest iteration of the company’s new technology platform, shrinks softly to wrap delicate goods without distorting them and conforms closely to contoured and irregularly shaped products. Its tear strength, depending on thickness, varies from about 30 g/mil to well over 90 g/mil, which is far greater than the 2 to 20 g/mil typically found in other shrink films. Packagers can thus use thinner grades of Xenith3 films without sacrificing packaging performance

. Xenith3 film can operate in a shrinking range from 150° to 400°F. The low end of the shrink range in most other films typically starts at 220°F. The ability to shrink at a relatively low temperature can reduce utility bills and makes this film an ideal product for wrapping heat-sensitive items. The film also runs well on a wide range of shrink equipment and with many types of sealing mechanisms.

According to the company, Xenith3 film is a substantial improvement over Xenith2 film. It provides better slip, so it is easier to handle and process, and it has better clarity and gloss, so products remain visible to consumers. It also meets FDA food contact requirements, which expands its application range. As a robust film, Xenith3 films keep products at a peak presentation level in shipping, during the warehouse and retail operations, and when handled by consumers.

Topas COC is a clear polymer used in shrink films either as a mono-film blend of COC and polyolefin or as a layer in multilayer structures. In addition to its high shrinkage at low shrink force and excellent stiffness, it offers the ability to adjust shrink curves from steep to flat; as well as good die-cutting, printing, and metallization characteristics. It also is a halogen-free polymer that provides good recyclability.

Comments: Heat-shrinkable films are made by stretching (orienting) a film at a temperature close to its softening point and quenching or freezing the film in the oriented state. This film during packaging when heated shrinks to its original state wrapping around the product to be packaged. Shrink films are currently used to package products such as fresh food; individual products such as paper, books, compact discs, and others. Other application includes unitizing multiple items such as soap bars, soft drinks, and phone books. The type of shrink film used will depend on the end-use application as different films exhibit a variety of properties such as strength, optical clarity, shrink temperature range, shrink force, seal strength, and others.

Sealed Air is one of the largest producers of shrink film and with the new product will be able to increase its product portfolio allowing new applications to be shrink-wrapped.

Contact us at ADI Chemical Market Resources to learn how we can help.