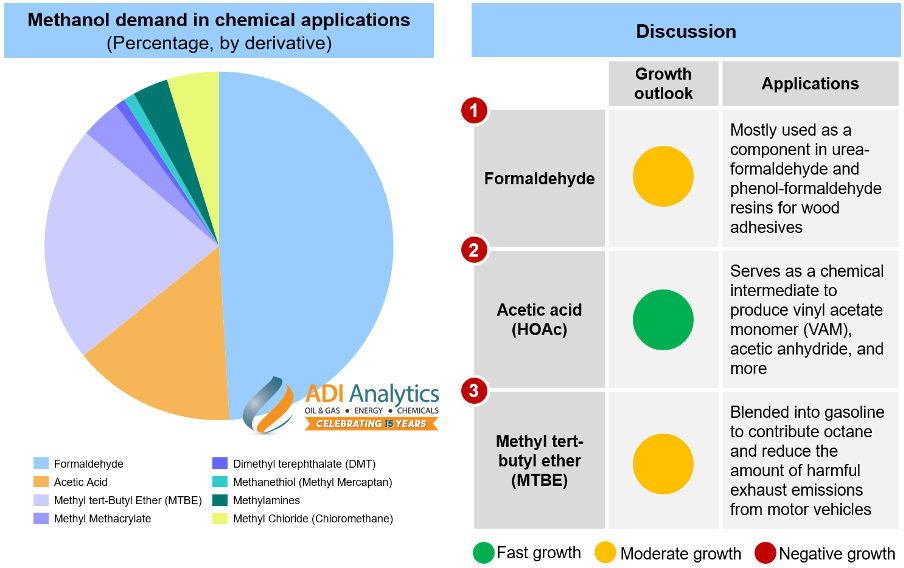

Methanol is a versatile chemical traditionally used to produce a wide range of other commodity chemicals like formaldehyde, acetic acid, and MTBE. Formaldehyde, acetic acid, and MTBE are the three primary chemicals that make up around 85% of methanol’s use in chemical applications. Formaldehyde is used to make urea-formaldehyde and phenol-formaldehyde resins, which are widely used in wood adhesives. On the other hand, MTBE serves as a gasoline additive that increases octane and oxygen levels in gasoline, while reducing pollution emissions. However, unlike formaldehyde and MTBE, acetic acid shows promise for much faster growth driven by its application as a chemical intermediate for application in plastics, textiles, and rubber (see Exhibit 1).

Exhibit 1. Formaldehyde, acetic acid, and MTBE collectively account for ~85% of methanol demand in chemical applications.

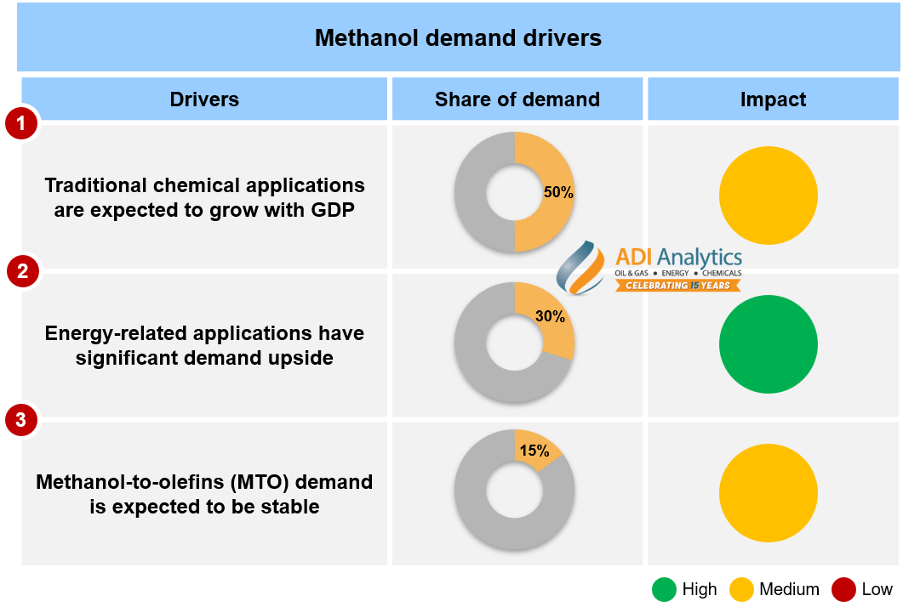

While traditional chemical applications remain important and are expected to grow steadily with GDP, methanol is now enjoying new interest in energy-related applications, especially as a marine fuel. In line with the global shift towards renewable energy sources and the International Maritime Organization (IMO)’s 2050 goals to decarbonize the shipping industry low-carbon methanol is becoming a viable solution for the maritime industry as an alternative fuel. ADI Analytics has previously shared insights on the IMO’s efforts to decarbonize the shipping industry, highlighting the benefits of utilizing methanol as a marine fuel (view here). This transition will help reduce greenhouse gas emissions and improve the sustainability of maritime operations. Thus, energy-related applications are expected to be the primary driving force behind the methanol demand in the coming future (see Exhibit 2).

Exhibit 2. Methanol demand growth in the future will be mainly led by its use as a fuel.

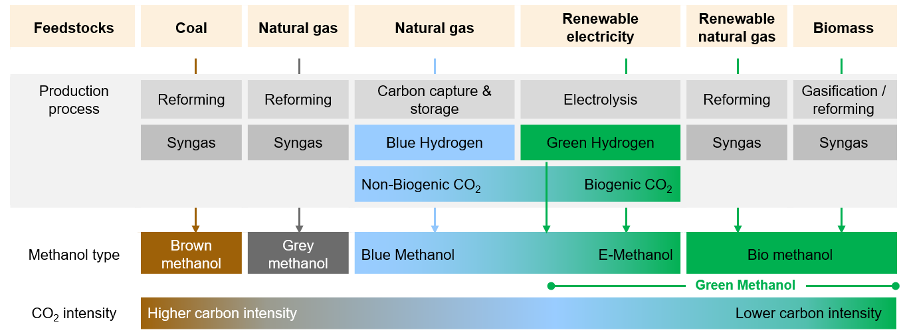

Conventionally, methanol is produced from coal (brown methanol) or natural gas (grey methanol), but these methods lead to significant emissions. Brown methanol can emit up to 300g CO2eq/MJ, while grey methanol can emit up to 95g CO2eq/MJ. In contrast, low-carbon methanol can be produced either by integrating carbon capture into the conventional methanol production process or by using renewable feedstocks. Blue methanol, for example, is derived from natural gas but is produced with industrial-captured CO2 to reduce the carbon intensity of the methanol produced. The most sustainable option is green methanol, which can be produced from renewable sources such as biomass or green hydrogen with biogenic captured CO2, resulting in a carbon footprint as low as 10g CO2eq/MJ (see Exhibit 3).

Exhibit 3. Current and emerging feeds and production pathways to low-carbon methanol.

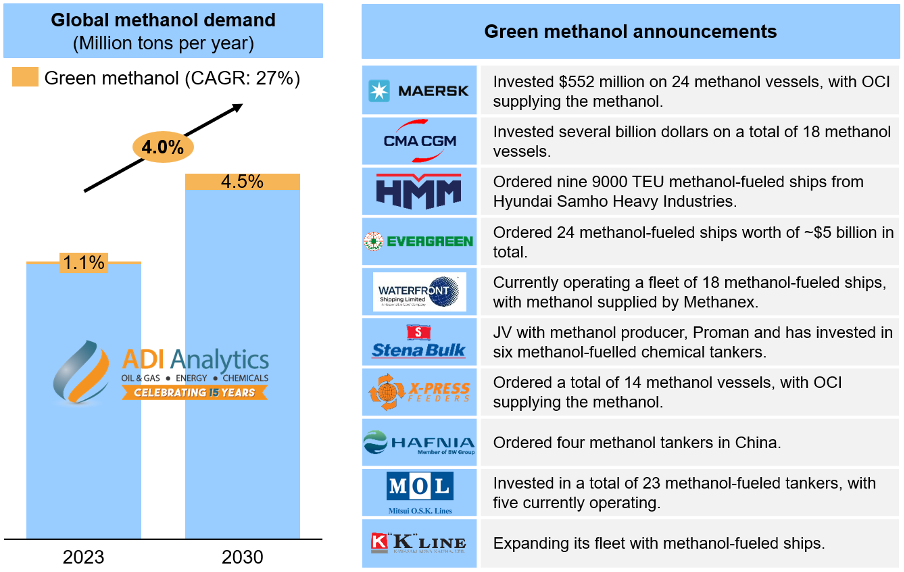

Many companies in the maritime industry are turning to green methanol as a fuel source due to its low carbon intensity. Established players such as Maersk and X-Press Feeders have invested billions of dollars in methanol vessels and secured green methanol supply agreements from OCI Global. To meet the growing demand, OCI Global has announced its plan to double the green methanol production capacity at its facility in Texas, US. Additionally, Stena Bulk has formed a joint venture with Proman to fuel its methanol tankers. Companies like CMA CGM, HMM, and Evergreen have also made significant investments in purchasing methanol-powered fleets and tankers. Despite currently representing only 1.1% of global methanol demand, the growth trajectory of green methanol is impressive. It is expected to reach approximately 5% of the global total demand by 2030, with a projected growth rate of 27% (see Exhibit 4).

Exhibit 4. Green methanol will grow 27% annually until 2030, with several maritime companies already making big bets.

As the world moves towards a more sustainable future, green methanol is leading the way for eco-friendly maritime practices. This revolutionary green fuel not only reduces the industry’s environmental impact but also sets a course toward a cleaner, greener future.

By Edmund Lam