Global demand for polyolefins increased annually at 3.7%, from 68 million metric tons per year (MMtpy) in 1997 to 160 MMtpy in 2017. This growth has been accompanied by a significant geographical shift in demand, which has gone from North America and Europe constituting over 50% global demand to China and Asia-pacific being the major markets today.

Polyolefins consumption in Russia has been growing annually at 3.2% during 2010-2017 facilitated by economic growth, governmental support, and feedstock availability. The Russian government approved the protection policy, an action plan for import substitution in refining and petrochemical industries, establishing a goal to bring the share of import of polyethylene and polypropylene down from 26-36% and 10-15%, respectively, in 2014 to zero by 2020.

Three years later, the polyethylene import has shrunk to 24-26%, while the progress in polypropylene substitution remains marginal. Exhibit 1 below shows polyethylene imports dropping successfully, however import substitution in polypropylene market has remained unsuccessful. Although the idea remains too optimistic, considering the broad variety of grades and consumer attributes, it is possible to minimize import by building grass-root petrochemical facilities and expansion of the existing ones. Russia and the CIS have an abundance of feedstock with approximately 20 billion tonnes of proven oil reserves and 60 trillion cubic meters of proven gas reserves.

Exhibit 1. Polyethylene and Polypropylene market in Russia

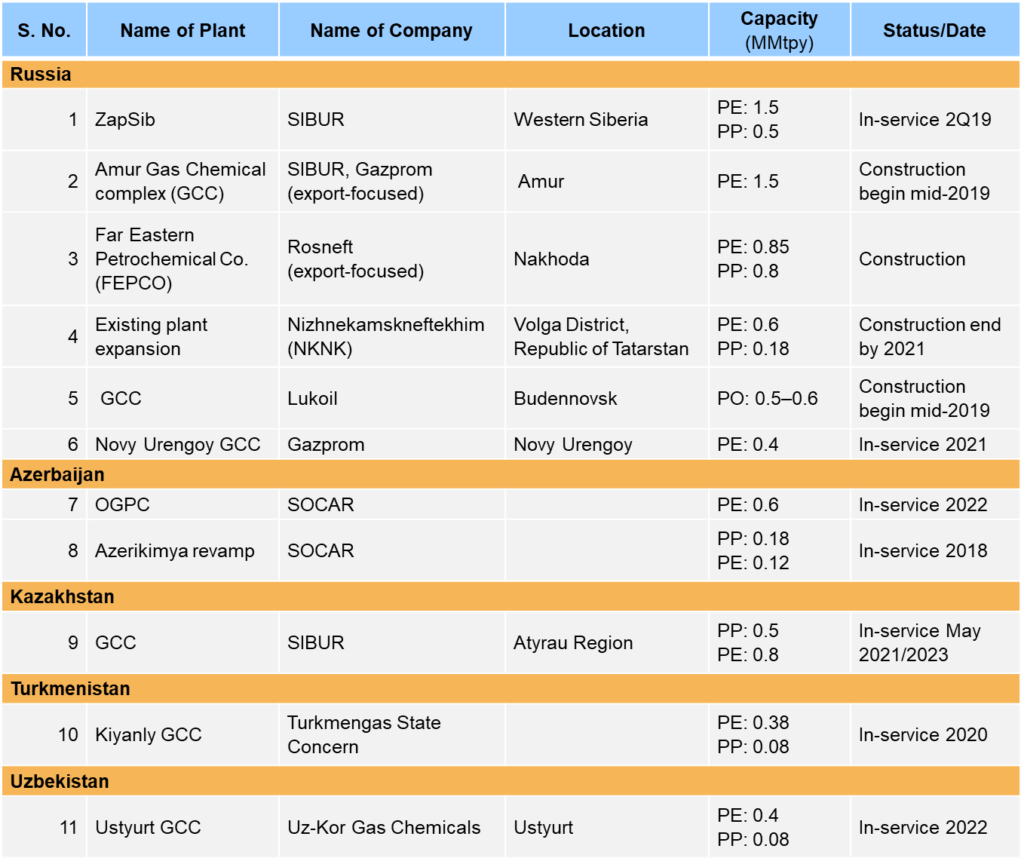

Given this background and government policy, several petrochemical projects have been proposed in Russia. The polyolefin projects in Russia and other CIS countries are listed in Exhibit 2, although other CIS countries do not have an import substitution agenda and are more driven by feedstock availability. In conclusion, the availability of feedstock remains one of the crucial drivers of polyolefin production in Russia and CIS with a contribution from the protectionism policy that aims to minimize petrochemical imports. These two factors will collectively drive the future of petrochemical projects in Russia and the CIS.

Exhibit 2. Petrochemical/Gas Chemical Complexes announced in Russia

ADI Chemical Market Resources is actively researching the polymer and chemical markets and applications. With over 500 projects our clients span the entire chemical value chain with profiles such as chemical industry stakeholders including distributors, end-users, EPC companies and technology licensors, traders, private equity and venture capital investors. Our recent work includes a detailed strategic analysis on global polyoelfins. Visit www.adi-cmr.com and contact us at info@adi-cmr.com or +1 281 506 8234 to learn more.

By Panuswee Dwivedi and Uday Turaga